Tactically LONG, but raising the accumulation range and the take-profit threshold

While both fiscal packages and the potential change in the debt brake rule suggest a higher medium-term fair value for the 10-year Bund in the 3.0-3.50% range, we believe the near-term risks aligned with our tactical horizon are skewed to the downside for 10Y Bund yields. For the following reasons:

1) Although the new German and European fiscal stance supports growth, the balance sheet expansion is expected to be limited this year, resulting in only a marginal improvement in the economic outlook in 2025. We are incorporating a 0.2 percentage point upward revision to our 2025 German growth forecast. As a result, we now anticipate real GDP growth in Germany for 2025 at 0.2% (up from 0.0% previously), compared to a decline of -0.2% in 2024. For the Euro Area, this adjustment raises our 2025 growth forecast from 0.8% to 1.0%, factoring in the positive feedback loop with Germany's main trading partners.

2) While supply risks are heavily skewed to the upside over the medium term, we expect the increase to be moderate this year due to time constraints. Based on past experience, it is highly probable that Germany will predominantly use T-bills to meet any additional financing requirements this year, given the time constraints. This approach should help alleviate selling pressure on long-term maturities, at least in the short term.

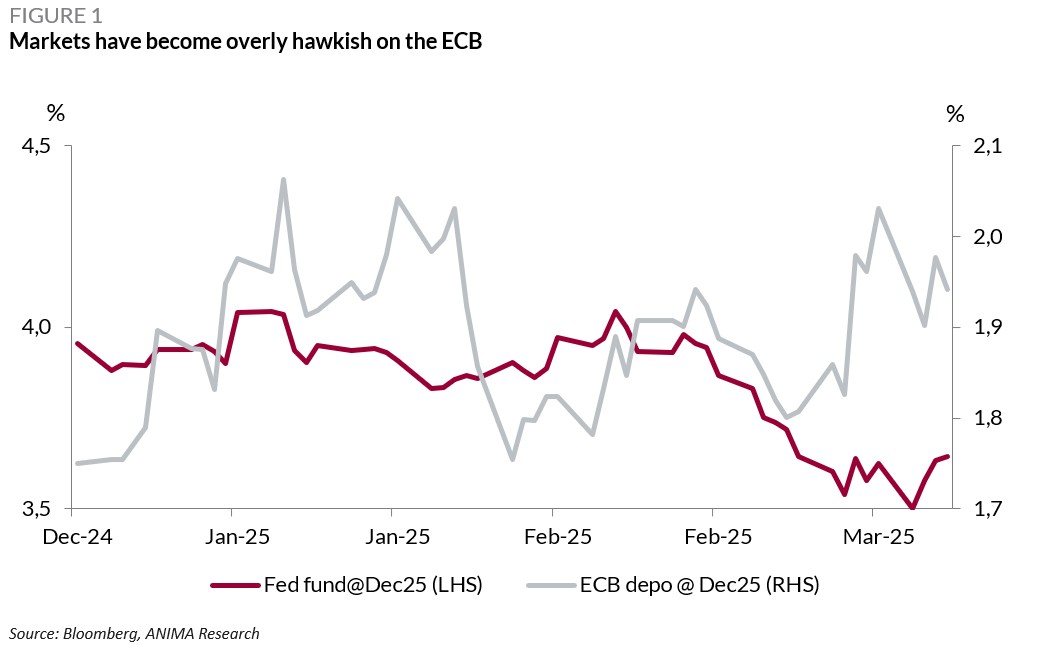

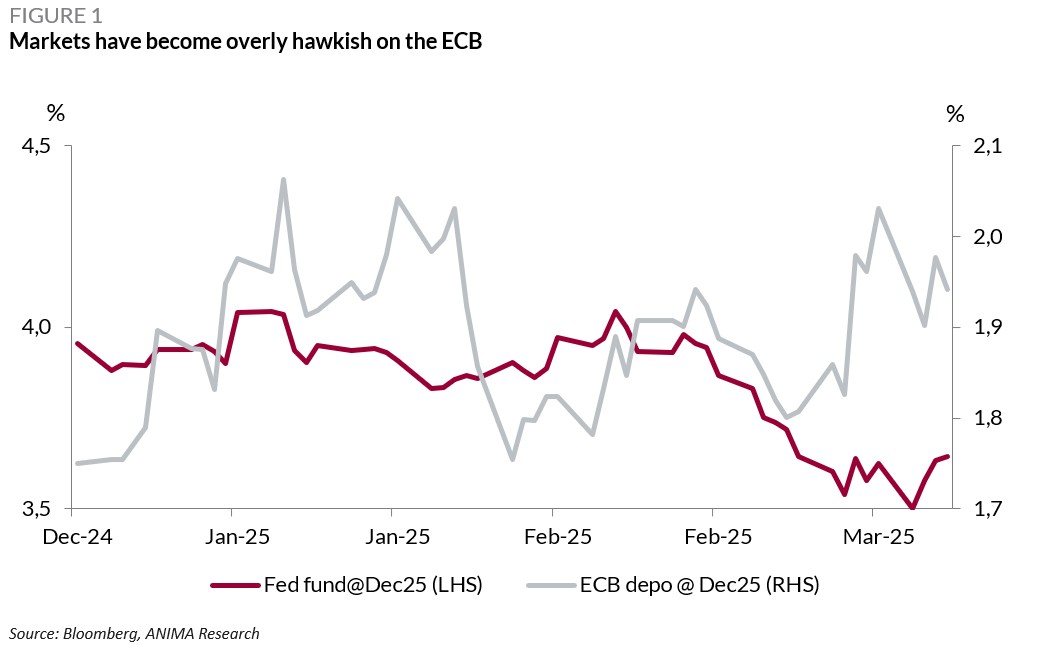

3) We still expect the ECB to implement three additional rate cuts this year, while the market is currently pricing in fewer than two.

As shown in Figure 1, since the end of February, there has been a noticeable decoupling in monetary policy expectations across the Atlantic. While the market has adopted a more hawkish stance on the ECB, driven by the announcement of the fiscal package in Germany and European package on defense, it has taken a more dovish view on the Fed. Given our growth and inflation forecasts for the EA this year, we believe the ECB will continue to lower rates slightly below neutral, irrespective of the final size of the fiscal package in Germany.

4) Tariff risks from the US may lead investors to focus on safe assets, such as Bunds.

Chiara Cremonesi

Senior Rates Strategist

Investment Research

Marketing material for professional clients or qualified investors only.

This material does not constitute an advice, an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. ANIMA can in no way be held responsible for any decision or investment made based on information contained in this document. The data and information contained in this document are deemed reliable, but ANIMA assumes no liability for their accuracy and completeness.

ANIMA accepts no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material in violation of this disclaimer and the relevant provisions of the Supervisory Authorities.

This is a marketing communication. Please refer to the Prospectus, the KID, the Application Form and the Governing Rules (“Regolamento di Gestione”) before making any final investment decisions. These documents, which also describe the investor rights, can be obtained at any time free of charge on ANIMA website (www.animasgr.it). Hard copies of these documents can also be obtained from ANIMA upon request. The KIDs are available in the local official language of the country of distribution. The Prospectus is available in Italian/English. Past performances are not an indicator of future returns. The distribution of the product is subject to the assessment of suitability or adequacy required by current regulations. ANIMA reserves the right to amend the provided information at any time. The value of the investment and the resulting return may increase or decrease and, upon redemption, the investor may receive an amount lower than the one originally invested.

In case of collective investment undertakings distributed cross-border, ANIMA is entitled to terminate the provisions set for their marketing pursuant to Article 93 Bis of Directive 2009/65/EC.