Tactically LONG, strategically NEUTRAL.

Tactically, we anticipate further dollar weakness

Following the revision of our macro-outlook, we have shifted to a tactically LONG position on EUR/USD from a previous NEUTRAL stance. The rationale behind this move is threefold.

1) We expect the USD to soften in the coming months, as the self-inflicted economic damage from tariffs could deteriorate the US macroeconomic backdrop. Despite the fact Trump exempted for 90 days most countries from higher tariffs on April 9th, he announced also an unprecedented tariff increase to China to around 125% from 54% previously. Therefore, if maintained, we anticipate a still large economic slowdown in the US, which should lead to further dollar weakness, as the full impact of the tariffs has not yet been priced in.

2) We believe market participants' hopes for a Fed "put" are overly optimistic. We continue to think the lack of clarity regarding Trump’s tariff policies will keep the Fed on hold throughout the summer. FOMC members have repeatedly stated that they need clarity before cutting rates again, and we don’t expect any clarity on Trump’s tariff policies anytime soon. Even assuming the most affected countries seek to negotiate, such negotiations take time, and success is not guaranteed. Therefore, we believe the Fed will remain cautious and focus on hard data. As inflation risks are likely to materialise before any deterioration in the labour market, we think the central bank will err on the hawkish side this time, which will likely dampen growth.

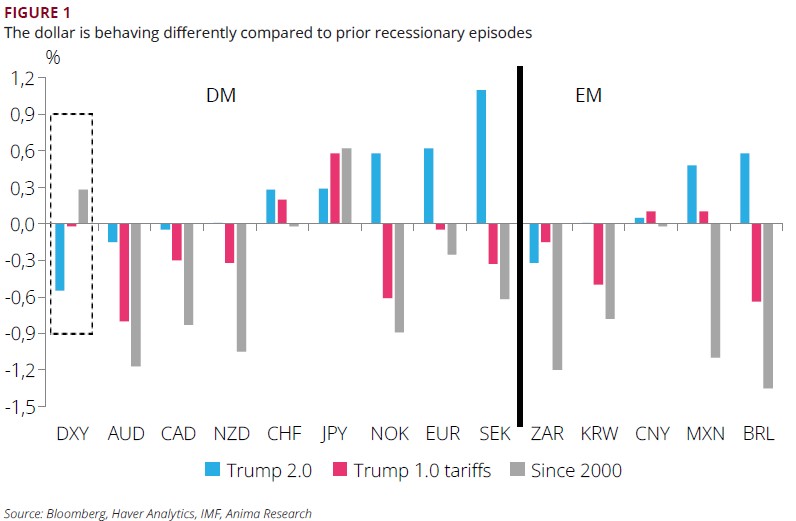

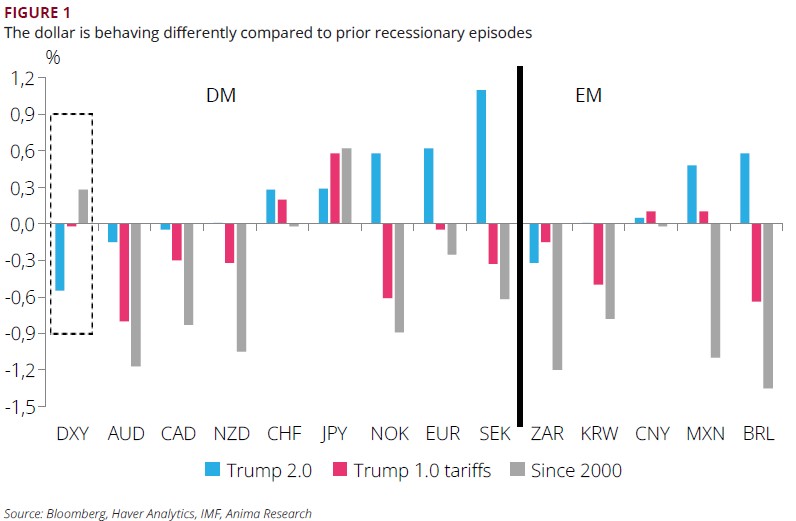

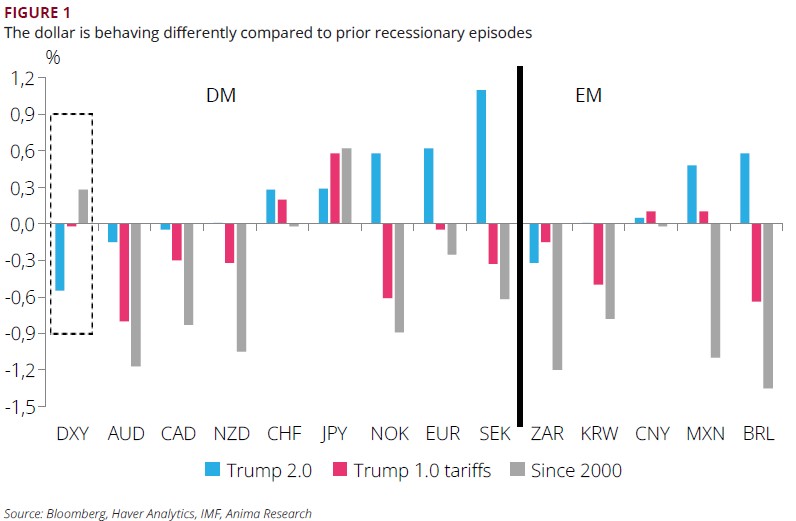

3) In Trump 2.0, the dollar is behaving differently compared to prior recessionary or risk-off episodes. Chart 9 shows that in all of the most recent risk-off episodes, the DXY has consistently acted as a safe-haven asset. However, this time looks different: so far, the DXY has not substantially appreciated. We believe that Trump’s significant departure from America’s traditional geopolitical stance on multiple fronts (international free trade, the Russia-Ukraine war, the future of NATO, the “quest” for Greenland) is damaging, though not eliminating, the dollar prestige as “the” reserve currency. On this occasion, we do not rule out that market participants might turn to the CHF and JPY instead.

Strategically, we expect the dollar to bottom out, but not to rally

Following the revision of our macro-outlook, we have shifted to a strategically NEUTRAL stance on EUR/USD, from a previous LONG position. The rationale behind this move is twofold:

1) If maintained, the strain exerted by tariffs on the global economy should begin to support the dollar (dollar-positive). So far, global growth has not been significantly affected to drive up the dollar. However, Trump’s back and forth on tariffs has already started to dampen trade sentiment among DMs and EMs and, moreover, we believe that if the tariff burden persists, it will create a noticeable drag on global growth by materially disrupting international trade and further impacting business confidence worldwide. In this scenario, we expect the dollar to regain some strength.

2) The Fed resuming rate cuts to rescue the economy will limit dollar re-appreciation (dollar-negative). We expect the dollar's re-appreciation to face a ceiling once the Fed begins cutting rates to stimulate the economy.

Valerio Ceoloni

Senior EM/FX Strategist

Investment Research

Download full document

Marketing material for professional clients or qualified investors only.

This material does not constitute an advice, an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. ANIMA can in no way be held responsible for any decision or investment made based on information contained in this document. The data and information contained in this document are deemed reliable, but ANIMA assumes no liability for their accuracy and completeness.

ANIMA accepts no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material in violation of this disclaimer and the relevant provisions of the Supervisory Authorities.

This is a marketing communication. Please refer to the Prospectus, the KID, the Application Form and the Governing Rules (“Regolamento di Gestione”) before making any final investment decisions. These documents, which also describe the investor rights, can be obtained at any time free of charge on ANIMA website (www.animasgr.it). Hard copies of these documents can also be obtained from ANIMA upon request. The KIDs are available in the local official language of the country of distribution. The Prospectus is available in Italian/English. Past performances are not an indicator of future returns. The distribution of the product is subject to the assessment of suitability or adequacy required by current regulations. ANIMA reserves the right to amend the provided information at any time. The value of the investment and the resulting return may increase or decrease and, upon redemption, the investor may receive an amount lower than the one originally invested.

In case of collective investment undertakings distributed cross-border, ANIMA is entitled to terminate the provisions set for their marketing pursuant to Article 93 Bis of Directive 2009/65/EC.