Following the NPC March meeting, we stick to our strategically neutral macro view on China.

On March 5, the 2025 National People’s Congress (NPC) unveiled the Government Work Report (GWR), outlining China’s economic strategy for the year.

Overall, the GDP and inflation targets for 2025 appear slightly more optimistic than both our projections and market expectations. However, the government bond issuance quota came in lower than anticipated, mainly due to reduced CGSB and LGSB issuance quotas. We expect an acceleration in bond issuances and government spending in the coming months, though it remains unclear whether the fiscal package fully accounts for the additional 20% US tariffs on Chinese goods.

Based on the fiscal figures released, we believe the government’s funding plans for bank recapitalisation and the consumer goods trade-in program may be more constrained than initially expected. Additionally, given the ambitious growth target of “around 5%” and policymakers’ strategy of implementing incremental policy measures in phases, there is a chance that further off-budget funding arrangements could be introduced later this year—potentially during a bi-monthly NPC Standing Committee meeting—if economic pressures intensify.

Key takeaways from the NPC are:

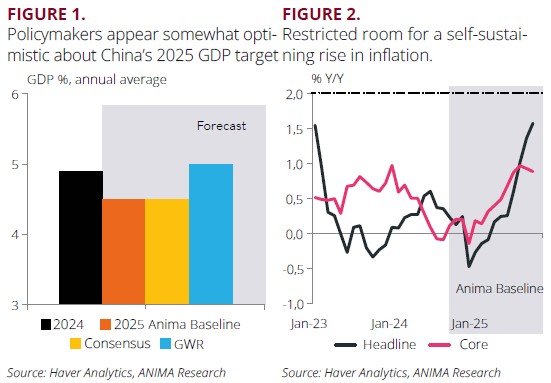

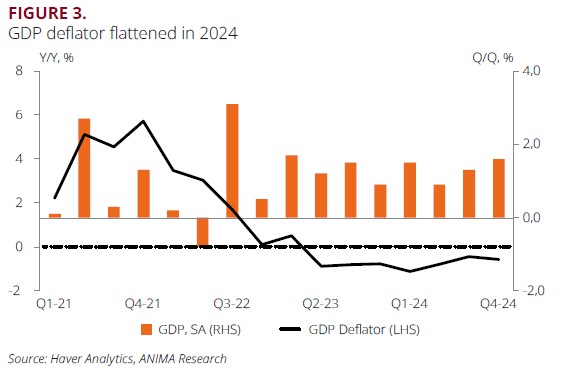

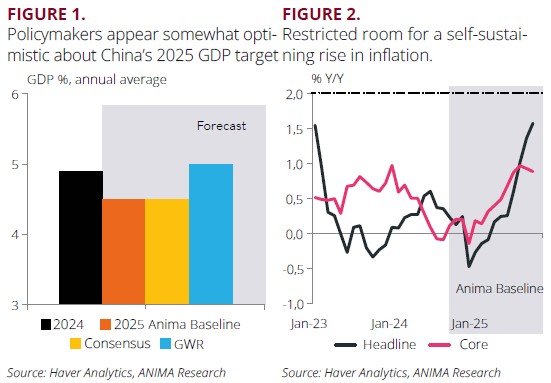

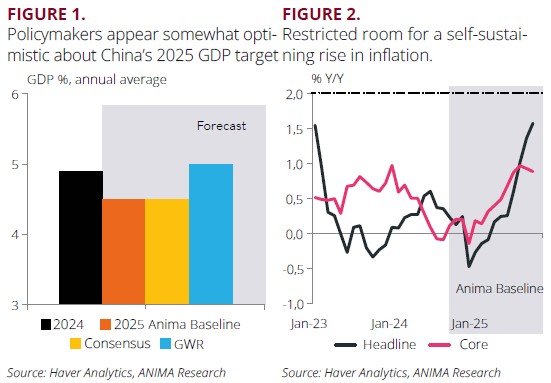

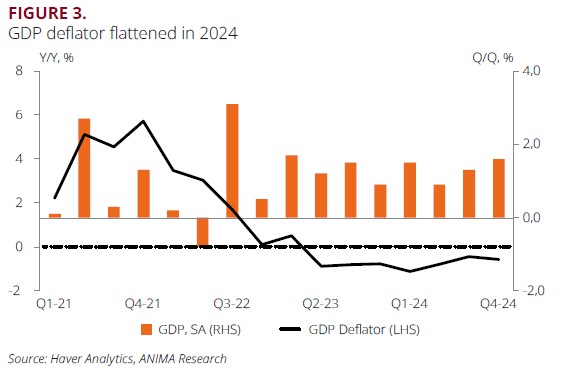

• GDP and Inflation Targets – In our view, policymakers appear slightly too optimistic. The report indicates that the government has kept its 2025 real GDP growth target at “around 5%”, unchanged from last year, while lowering the CPI inflation target to “around 2%” (down from “around 3%” in 2024, Figures 1-2). These targets appear somewhat ambitious relative to our outlook, as we anticipate persistent growth challenges driven by increasing external pressures from tariffs and sluggish domestic demand, alongside near-zero inflation limiting real growth (Figure 3).

• Bond Quotas and Fiscal Targets – Fiscal support is expected to expand moderately, with the fiscal deficit increasing to -4% of GDP in 2025 from -3% in 2024. The central government special bond (CGSB) net issuance quota has been set at RMB 1.8tn for 2025, up from RMB 1.0tn last year. This includes RMB300bn allocated to the consumer goods trade-in program (vs. RMB 150bn in 2024) and RMB 500bn for bank recapitalisation (vs. none in 2024), leaving the remaining RMB 1tn for equipment upgrades and strategic investments.

The local government special bond (LGSB) net issuance quota stands at RMB 4.4tn (vs. RMB 3.9tn in 2024), likely directed toward infrastructure projects, property sector funding (land and housing purchases), and local debt resolution.

In total, government bond net issuance for 2025 is expected to reach RMB 11.9tn—higher than RMB9tn in 2024 but falling short of market expectations of RMB 12-13tn.

• Local Government Debt Resolution – The strategy remains in line with expectations and commitments made during the October Policy Pivot. According to the GWR, policymakers have earmarked RMB 2.8tn for local government debt resolution in 2025, maintaining the same level as the previous year. This allocation comprises RMB 800bn from the new LGSB issuance quota and RMB 2tn from local government refinancing bonds. Additionally, authorities are taking a flexible approach by dynamically adjusting the list of high-risk regions, ensuring a balance between debt resolution and economic growth while creating more space for investment.

Valerio Ceoloni

Senior EM/FX Strategist

Investment Research

Download full document

Marketing material for professional clients or qualified investors only.

This material does not constitute an advice, an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. ANIMA can in no way be held responsible for any decision or investment made based on information contained in this document. The data and information contained in this document are deemed reliable, but ANIMA assumes no liability for their accuracy and completeness.

ANIMA accepts no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material in violation of this disclaimer and the relevant provisions of the Supervisory Authorities.

This is a marketing communication. Please refer to the Prospectus, the KID, the Application Form and the Governing Rules (“Regolamento di Gestione”) before making any final investment decisions. These documents, which also describe the investor rights, can be obtained at any time free of charge on ANIMA website (www.animasgr.it). Hard copies of these documents can also be obtained from ANIMA upon request. The KIDs are available in the local official language of the country of distribution. The Prospectus is available in Italian/English. Past performances are not an indicator of future returns. The distribution of the product is subject to the assessment of suitability or adequacy required by current regulations. ANIMA reserves the right to amend the provided information at any time. The value of the investment and the resulting return may increase or decrease and, upon redemption, the investor may receive an amount lower than the one originally invested.

In case of collective investment undertakings distributed cross-border, ANIMA is entitled to terminate the provisions set for their marketing pursuant to Article 93 Bis of Directive 2009/65/EC.