Following a meeting in Geneva, the US and China reached an unexpected temporary agreement to substantially reduce reciprocal tariffs for a 90-day period.

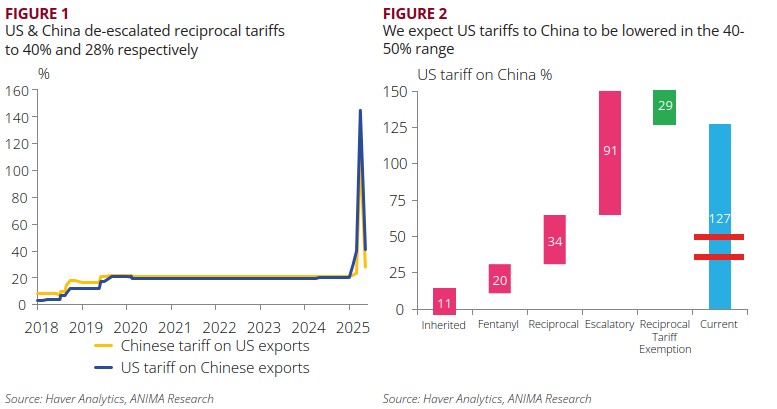

We interpret this development as a positive signal towards a potential broader and long-lasting trade agreement between the two countries. Based on this, we believe tariffs on Chinese goods could be reduced to an effective range of 45–55%, down from 145% after Liberation Day. Consequently, we are raising our baseline growth forecast for China in 2025 to 4.7% from 4.2%, as we now expect exports to pose less of a drag on growth. However, we caution that the outcome of this 90-day “grace period” remains uncertain: the bar to achieve a meaningful and lasting trade deal is high, and it may take longer than 90 days.

1. US-China trade: 90-day grace period to strike a deal

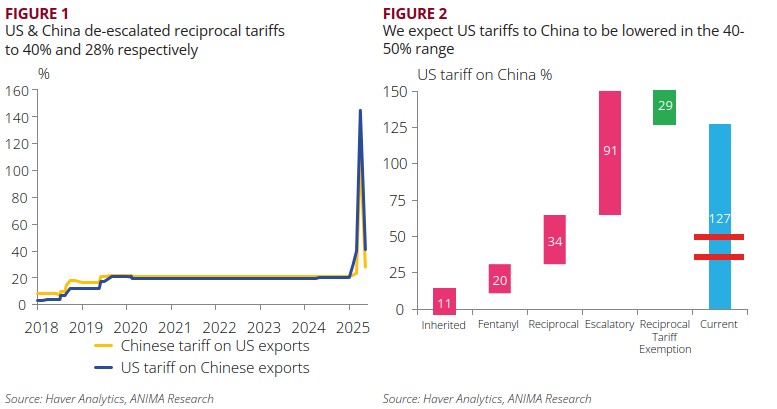

Both countries have unexpectedly agreed to ease tariffs on each other’s goods. Under the terms of the agreement, the US will lower tariffs on most Chinese imports from 145% to an effective 40%, while China will cut duties on American products from 125% to an effective 28% (Figure 1). This coordinated action is aimed at easing trade tensions and offers both sides a 90-day window to continue negotiations on economic and trade issues. A framework has also been established to support ongoing dialogue. While the agreement represents an unexpected step forward in de-escalating the trade conflict, it remains unclear what outcomes would be acceptable to both parties or how long a permanent solution may take. China has previously demanded the removal of all US tariffs imposed this year, a condition we believe is unlikely to be met.

VALERIO CEOLONI

Senior EM/FX Strategist

Marketing material for professional clients or qualified investors only.

This material does not constitute an advice, an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. ANIMA can in no way be held responsible for any decision or investment made based on information contained in this document. The data and information contained in this document are deemed reliable, but ANIMA assumes no liability for their accuracy and completeness.

ANIMA accepts no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material in violation of this disclaimer and the relevant provisions of the Supervisory Authorities.

This is a marketing communication. Please refer to the Prospectus, the KID, the Application Form and the Governing Rules (“Regolamento di Gestione”) before making any final investment decisions. These documents, which also describe the investor rights, can be obtained at any time free of charge on ANIMA website (www.animasgr.it). Hard copies of these documents can also be obtained from ANIMA upon request. The KIDs are available in the local official language of the country of distribution. The Prospectus is available in Italian/English. Past performances are not an indicator of future returns. The distribution of the product is subject to the assessment of suitability or adequacy required by current regulations. ANIMA reserves the right to amend the provided information at any time. The value of the investment and the resulting return may increase or decrease and, upon redemption, the investor may receive an amount lower than the one originally invested.

In case of collective investment undertakings distributed cross-border, ANIMA is entitled to terminate the provisions set for their marketing pursuant to Article 93 Bis of Directive 2009/65/EC.